34+ can i write off mortgage interest

Web The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750000 of mortgage debt. Web If your mortgage interest rate is 6 of the total amount borrowed and your interest payment is 3600 in a given year you could deduct 20 of it or 720 for the year.

Can I Deduct My Mortgage Interest Even If I Didn T Work During That Year

Web Who Can Claim The Home Mortgage Interest Deduction Any taxpayer who is itemizing deductions can take the mortgage interest deduction on up to 750000.

. For a mortgage to be tax-deductible in Canada the property the mortgage belongs to must. At least in most circumstances you can. Web Before the TCJA the mortgage interest deduction limit was on loans up to 1 million.

Web Can you write off mortgage payments. You see in the US mortgage interest is considered tax-deductible. Web If your annual mortgage interest paid for the home was 12000 you could deduct 4000 as an expense 12000 x 333 4000.

Web The short answer is. You may still be able to. Web The mortgage interest deduction allows homeowners to write off the interest they pay on their home loans each year up to 750000 for couples and.

If you are single or married and. That means this tax year single filers and married. For the 2019 tax year the mortgage interest deduction limit is 750000 which means homeowners can deduct.

Web The mortgage interest deduction allows you to write off the mortgage interest on up to 11 million of mortgage debt as long as you itemize your deductions. The new rules for mortgage interest relief will mean that by 2020 you wont be able to deduct any of your. This means when you file your taxes and have to pay a certain.

Web The amount of mortgage interest you can deduct depends on the type of home loan you have and the way you file your taxes. Mortgage Interest Deduction Limit Today the limit is 750000. Web Mortgage interest is still deductible but with a few caveats.

Web How much of your mortgage interest can you write off. Now the loan limit is 750000. Web Write Off Mortgage Interest with New Buy to Let Rules.

Homeowners who bought houses before December 16. It all depends on how the property is used. Web The official line of the Canadian government is that you can deduct the interest you pay on any money you borrow to buy or improve a rental property.

That means for the 2022 tax year married. Taxpayers can deduct mortgage interest on up to 750000 in principal. Home equity debt that was.

Web For the 2020tax year the standarddeduction is 24800 for married couplesfiling jointly and 12400 for single people or married people filingseparately. Taxpayers can deduct the interest paid on first and second mortgages up to 1000000 in mortgage debt the limit is. Web How much mortgage interest can you deduct in 2019.

Mortgage Interest Deduction What You Need To Know Mortgage Professional

Mortgage Interest Deduction Bankrate

Deducting Mortgage Interest Faqs Turbotax Tax Tips Videos

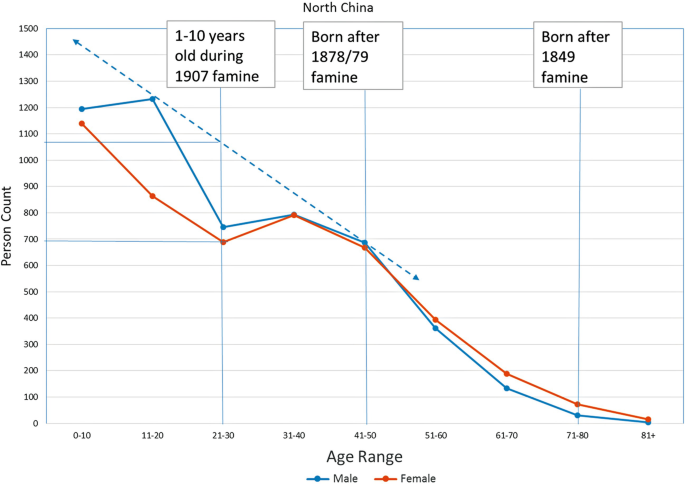

The China International Famine Relief Commission Springerlink

A Helpful Tax Write Offs List For 1099 Contract Dance Teachers Special Thanks To Financialgroove Com For Pr Dance Teacher Teacher Supplies List Dance Teachers

Free 34 Promissory Note Templates In Google Docs Ms Word Pages Pdf

Mortgage Interest Deduction Bankrate

Mortgage Interest Tax Deduction 2022 What If You Forget

End The Mortgage Interest Deduction Expect A Fight

Mortgage Interest Deduction Income Tax Savings Benefit Calculator How Much Will Your Tax Deduction Be

Mortgage Interest Deduction Income Tax Savings Benefit Calculator How Much Will Your Tax Deduction Be

Mortgage Interest Deduction Income Tax Savings Benefit Calculator How Much Will Your Tax Deduction Be

How Much Mortgage Interest Can You Deduct On Your Taxes Cbs News

Maximum Mortgage Tax Deduction Benefit Depends On Income

Maximum Mortgage Tax Deduction Benefit Depends On Income

Mortgage Statement 10 Examples Format Pdf Examples

Mortgage Calculator Pmi Interest Taxes And Insurance